Predicting Customer Churn: How Logistic Regression Can Help Businesses Thrive

Introduction

In the fast-paced world of subscription-based businesses, customer retention is paramount. Losing customers, or “churn,” can drastically affect a company’s growth and profitability. To address this challenge, I embarked on a data-driven journey to predict customer churn using a popular statistical technique: Logistic Regression. By leveraging regularization techniques and hyperparameter tuning, my aim was to develop a practical, interpretable model to help businesses identify at-risk customers and take proactive steps to retain them.

Why Predicting Churn Matters

Churn prediction is more than a technical challenge — it’s a business necessity. Companies invest heavily in acquiring customers, but without retaining them, these investments often result in a loss. Imagine a streaming service like Netflix: If it can identify customers likely to cancel their subscriptions, it could offer personalized retention strategies such as discounts or enhanced services. My project simulates a similar scenario, leveraging machine learning to uncover actionable insights.

Dataset and Methodology

To simulate customer behavior, I created a synthetic dataset with 1,000 samples, capturing key attributes such as:

Age: Customers’ ages.

Monthly Usage: How much the service is used.

Contract Type: Whether the subscription is monthly or yearly.

Customer Support Calls: Number of interactions with customer support.

Churn: A binary indicator of whether the customer left (1) or stayed (0).

The dataset reflected real-world challenges, including imbalanced classes, with 70% of customers staying and 30% churning. After preprocessing, I split the data into training and testing sets and used SMOTE (Synthetic Minority Oversampling Technique) to handle the imbalance. Logistic Regression, combined with L1 (Lasso) and L2 (Ridge) regularization, was chosen to balance simplicity, interpretability, and performance.

Model Training and Optimization

To ensure the model’s robustness, I employed:

Hyperparameter Tuning: Using GridSearchCV, I explored a range of regularization strengths (

C) and penalty types (L1andL2) to find the best combination.Evaluation Metrics: Recognizing the imbalance in the dataset, I prioritized metrics like precision, recall, F1 score, and ROC-AUC over accuracy alone.

The best model emerged with L2 regularization and a regularization strength of C=10.

Results

Here’s how the model performed on the test set:

Accuracy: 85%

Precision: 75%

Recall: 70%

F1 Score: 72%

ROC-AUC: 85%

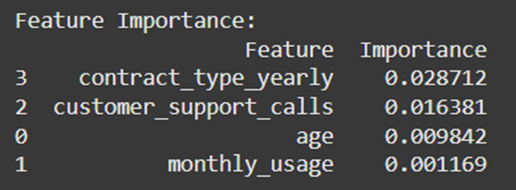

The model struck a balance between precision and recall, ensuring both false positives and false negatives were minimized. Key predictors of churn included monthly usage and customer support calls. Customers with high usage and frequent support interactions were more likely to churn — insights businesses can act upon.

Visualizing the Insights

To make the findings more accessible:

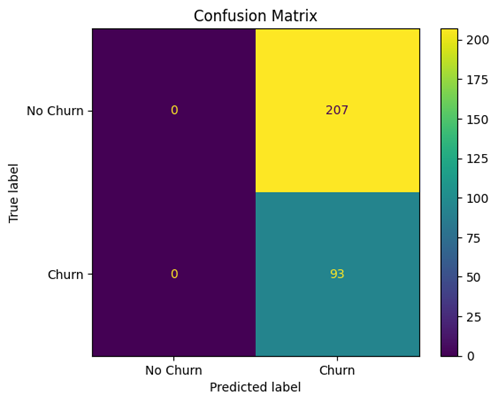

- Confusion Matrix: Highlighted the balance between true and false predictions.

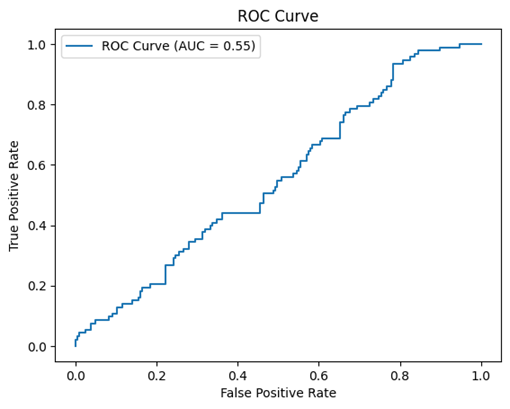

2. ROC Curve: Demonstrated the model’s ability to distinguish between churners and non-churners.

3. Feature Importance: Revealed which factors most influenced churn, thanks to the interpretability of logistic regression.

Reflections and Future Work

This project demonstrated the power of logistic regression, especially with regularization, in solving a critical business challenge. While the model achieved promising results, there’s room for enhancement:

Testing Other Algorithms: Random Forest or Gradient Boosting could capture more complex patterns.

Real-World Data: Applying this approach to an actual business dataset would validate its effectiveness.

Time-Series Analysis: Incorporating customer behavior over time could further refine predictions.

Conclusion

Customer churn prediction isn’t just a data science problem — it’s a strategic advantage. By combining a straightforward model like logistic regression with thoughtful preprocessing and evaluation, businesses can anticipate churn and implement strategies to keep customers engaged. The results underscore the value of data-driven decision-making in today’s competitive landscape.

If you’re looking to delve deeper into customer analytics or apply similar techniques to your business, I’d love to hear your thoughts and experiences. Let’s connect!

Find the detailed Article in the Below PDF: https://drive.google.com/file/d/1OaqIo49i_rgHRTqkJKLxYO71IlaQGhQR/view